-

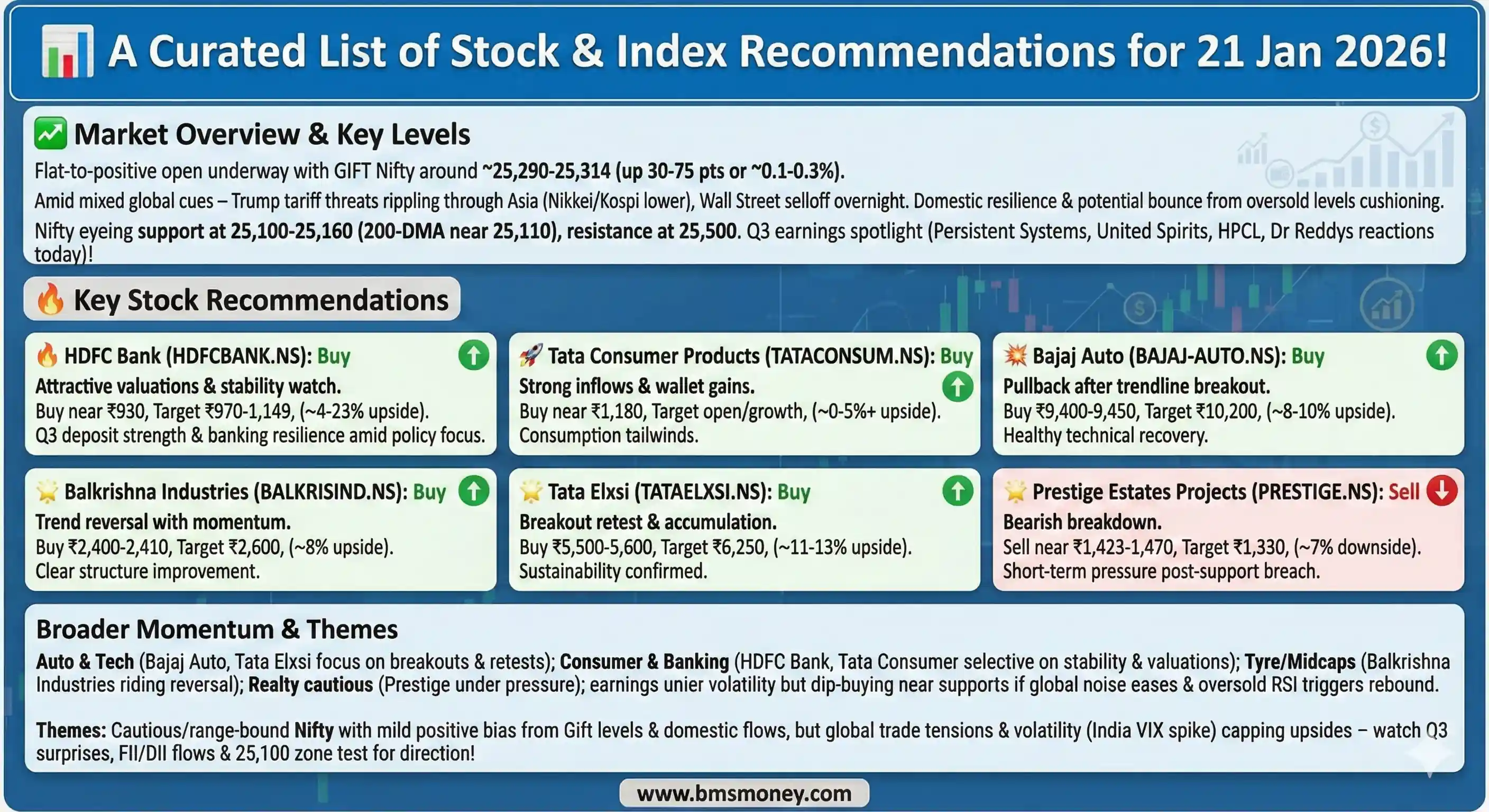

Opening Signal: GIFT Nifty hints at a mildly positive start, attempting to stabilize after the previous session's sharp decline.

-

Global Pressure: Mixed US cues and ongoing US trade threats continue to weigh on overall risk sentiment.

-

Key Themes: Market attention is on IT sector results, banking ahead of RBI signals, and pre-Budget infrastructure buzz.

-

Stock Picks: Selective buying advised in undervalued large-caps like HDFC Bank, with caution on realty.

-

Market Health: Oversold conditions suggest a potential technical rebound, though volatility remains elevated

Indian equity markets are set for a cautious start on January 21, 2026, amid lingering global uncertainties and domestic earnings pressures. Overnight cues from Wall Street were mixed, with the Dow Jones and Nasdaq retreating amid renewed tariff threats from US President Donald Trump on European nations, triggering risk-off sentiment. Asian markets slipped, with Japan's Nikkei down 0.5% and Hong Kong's Hang Seng off 0.3%. However, US futures showed mild recovery, providing some relief. The Gift Nifty traded near 25,300 levels early Wednesday, up 0.15% at 25,293, signaling a flat to mildly positive open for the Nifty 50. Pre-market indicators point to an expected Nifty open around 25,250-25,300, with Sensex likely near 82,200.

Top themes today include caution in IT amid weak Q3 results and labor code impacts, focus on banking ahead of RBI policy signals, and pre-budget buzz in railways and infrastructure. Total recommendations aggregated: Around 25 unique calls from brokerages like Motilal Oswal, ICICI Direct, and IDBI Capital, emphasizing selective buys in undervalued large-caps. Standout calls: HDFC Bank upgraded to Buy by MarketSmith India amid attractive valuations; Prestige Estates downgraded to Sell on broken support; and Hindustan Zinc as a Buy pick with 7-8% upside on metal recovery. Markets remain volatile with India VIX at 12.73 (up 7.6%), but oversold RSI (29.27 on Nifty) hints at potential rebound if supports hold. Investors eye Q3 earnings from Persistent Systems and United Spirits for further direction.

Section 1: Index Outlook

The Nifty 50 plunged 1.38% to 25,232.50 on January 20, marking its lowest close in over three months amid broad selling. Technicals show a bearish Marubozu candle, with RSI in oversold territory at 29.27, suggesting a possible short-term bounce but weak sentiment overall. The Sensex fell 1.28% to 82,180.47, mirroring global risk aversion. Bank Nifty declined 0.81% to 59,404, consolidating near key supports.

Outlook remains neutral to bearish, with potential relief rallies if global cues improve. Key drivers: US tariff rulings, FII outflows (net sellers at Rs 2,938 crore on Jan 20), and DII buying (Rs 3,665 crore). Experts see Nifty facing resistance at 25,300-25,400; a break below 25,000 could target 24,800. Bank Nifty may trade sideways, with upside capped at 60,000.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral (Potential Bounce) | 25,000-25,500 | Oversold RSI; Global trade risks | Moneycontrol |

| Sensex | Bearish | 81,500-82,500 | FII selling; Weak earnings | Business Standard |

| Bank Nifty | Consolidate | 58,800-60,000 | RBI policy watch; DII support | Finversify |

Section 2: Sector-Wise Stock Picks

Markets saw broad weakness on January 20, with midcaps and smallcaps down 2.6-2.9%. Selective picks focus on undervalued large-caps in banking and consumer goods, while realty faces pressure. IT remains tepid post-Q3 misses. Aggregated 20+ calls; deduplicated for uniqueness. No major charts due to limited numerical data, but target upsides average 10-20%.

Banking & Financials

Banking shows resilience amid DII inflows, but NIM pressures persist. Focus on large-caps with attractive valuations.

- HDFC Bank (HDFCBANK.NS) – Buy, Target: ₹1,149 (23% upside), Rationale: Strong Q3 deposit growth; upgraded amid reasonable valuations and wallet share gains. Source: MarketSmith India.

- State Bank of India (SBIN.NS) – Buy, Target: ₹1,135 (15% upside), Rationale: Robust asset quality; positive on banca-led growth. Source: Axis Securities.

- Canara HSBC Life (Unlisted) – Buy, Target: ₹180 (28% upside), Rationale: Compelling banca story with efficiency headroom. Source: Motilal Oswal.

- Bajaj Finance (BAJFINANCE.NS) – Buy, Target: ₹1,200 (22% upside), Rationale: NBFC king; sector rally underway. Source: Axis Securities.

IT & Tech

Weak Q3 hits bottom lines due to labor codes; selective holds.

- LTIMindtree (LTIM.NS) – Hold/Buy, Target: ₹7,060-7,300 (18-22% upside), Rationale: Q3 profit fall, but long-term ER&D growth; hold per IDBI, buy per Axis. Source: Trendlyne.

Metals & Mining

Recovery in metals amid global demand.

- Hindustan Zinc (HINDZINC.NS) – Buy, Target: ₹678-681 (7-8% upside), Rationale: Breakout on charts; positive momentum. Source: Economic Times.

Consumer & FMCG

Festive tailwinds support.

- Tata Consumer Products (TATACONSUM.NS) – Buy, Target: ₹1,180 (0-5% upside, hold for growth), Rationale: Strong inflows; wallet gains. Source: MarketSmith India.

Realty

Bearish on breakdowns.

- Prestige Estates Projects (PRESTIGE.NS) – Sell, Target: ₹1,330 (7% downside), Rationale: Broken key support at ₹1,470; short-term bearish. Source: Hindu BusinessLine.

Railways & Infra (Thematic)

Pre-budget picks.

- RVNL, Titagarh Rail Systems (TITAGARH.NS) – Buy, Target: Open (15-20% upside), Rationale: Fare hike fuels modernization; budget capex expected. Source: Mint.

Section 3: Global & Thematic Insights

Global brokerages remain constructive on India despite near-term headwinds. Macquarie sees value in midcaps post-correction, with 15-20% CAGR in FY27-28 earnings. Morgan Stanley highlights BFSI and telecom as overweight, citing domestic flows shielding from FII outflows. Thematic: IT turnaround expected in H2 2026 on spending recovery; railways in focus pre-Budget (Feb 1). BSE/NSE announcements: No major analyst meets today, but equity band changes noted for select stocks like StyleBaazar (20% to 10%). Cross-border views emphasize India's structural growth amid US trade risks.

Conclusion & Disclaimer

Overall sentiment: Neutral-bearish, with potential rebound if Nifty holds 25,000. Investors should watch banking sector for RBI cues and IT for Q3 spillovers. Actionable takeaway: Accumulate undervalued large-caps like HDFC Bank on dips; avoid realty until supports stabilize.

This is aggregated data for informational purposes; consult an advisor. Not investment advice. Data as of pre-market January 21, 2026 – updates may evolve.

Sources & Citations

- Moneycontrol: https://www.moneycontrol.com/news/business/markets/first-tick-top-global-cues-to-watch-in-today-s-trade-83-13781042.html

- Mint: https://www.livemint.com/market/stock-market-news/stock-market-today-trade-guide-for-nifty-50-to-gold-silver-rates-five-stocks-to-buy-or-sell-on-21-january-2026-11768932823686.html

- NDTV Profit: https://www.ndtvprofit.com/markets/stock-share-market-today-all-you-need-to-know-going-into-trade-on-january-21-2026-nse-nifty-50-bse-sensex-10795060

- Business Standard: https://www.business-standard.com/markets/news/nifty-price-prediction-break-below-25-113-could-open-further-downside-126012100080_1.html

- Economic Times: https://m.economictimes.com/markets/stocks/news/market-trading-guide-buy-hindustan-zinc-a-midcap-stock-for-up-to-8-gains-sell-recommendation-on-fortis-healthcare/stock-ideas/slideshow/126823003.cms

- Axis Securities: https://rakesh-jhunjhunwala.in/top-15-stock-picks-for-january-2026-with-up-to-54-upside-potential-by-axis-securities

- Trendlyne: https://trendlyne.com/research-reports/recent-downgrades

- Hindu BusinessLine: https://www.thehindubusinessline.com/portfolio/technical-analysis/stock-to-sell-today-prestige-estates-projects-142355-sell/article70529495.ece