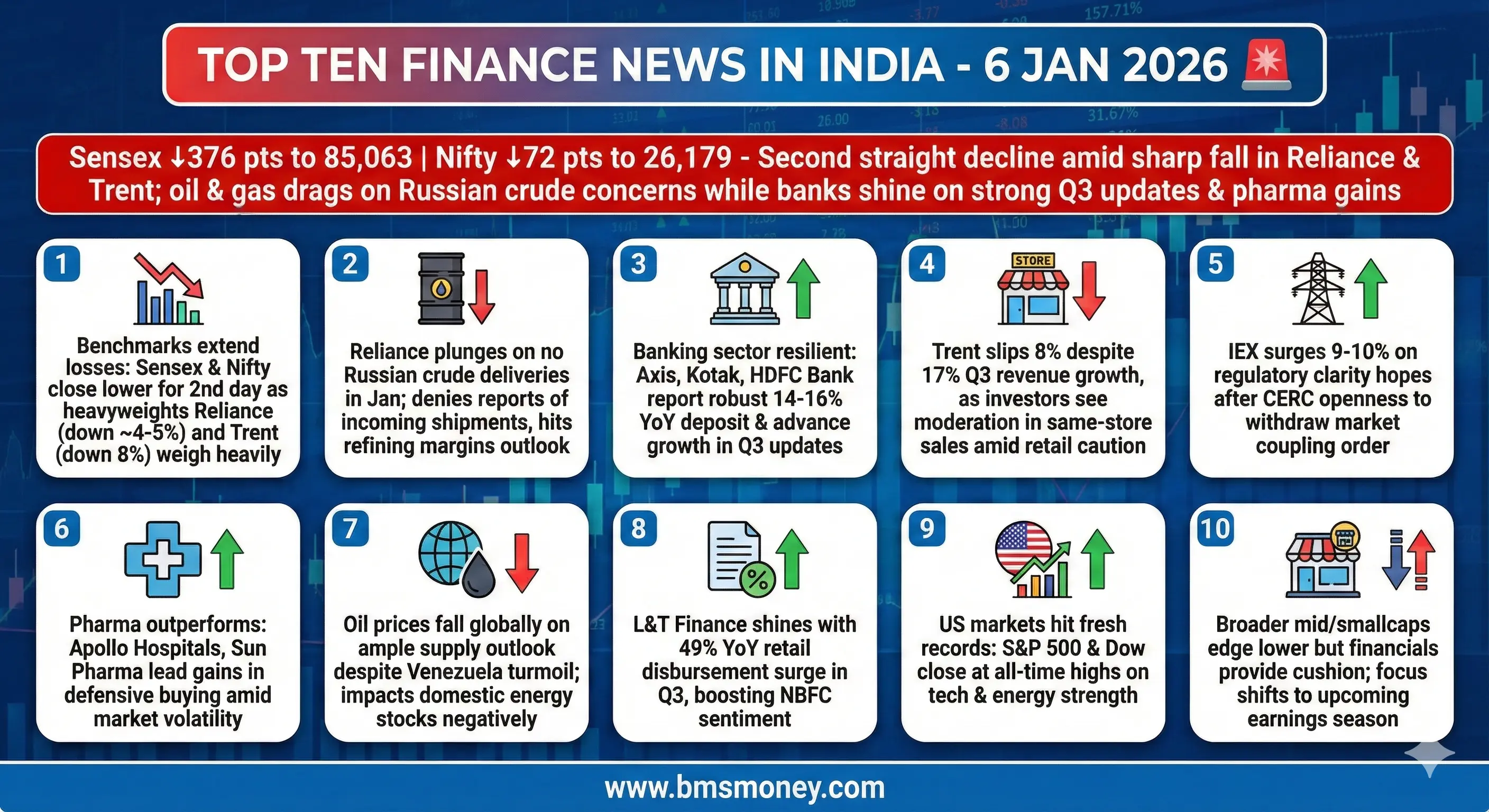

The Indian stock markets exhibited bearish sentiment on January 6, 2026, extending losses for the second consecutive session amid profit booking in heavyweight stocks and lingering concerns over global trade tariffs and geopolitical developments. Key themes included sector-specific resilience in banking and pharma, contrasted by weakness in oil & gas and retail, while positive Q3 business updates provided some support amid broader caution driven by Reliance Industries' sharp decline and uncertainty around Russian oil supplies.

Markets are set for a positive start on January 06, 2026, buoyed by strong global gains and surging commodity prices, with GIFT Nifty signaling a gap-up opening.

Key Themes & Picks

-

GIFT Nifty signals a gap-up opening, targeting 26,350–26,400 levels.

-

Metals and energy stocks rally on near-record commodity prices.

-

Banking sector in focus amid robust Q3 business updates.

-

Key calls: Upgrades for Metropolis Healthcare and Havells India.

-

Renewable energy push puts battery storage (BESS) in the spotlight.

Indian equity markets displayed volatility on January 05, 2026, with the Nifty 50 hitting a record high intraday before closing lower amid IT sector weakness and geopolitical concerns from US-Venezuela tensions. Key themes included cautious foreign investor sentiment, robust banking updates offsetting drags, and global energy surges impacting commodity costs.