-

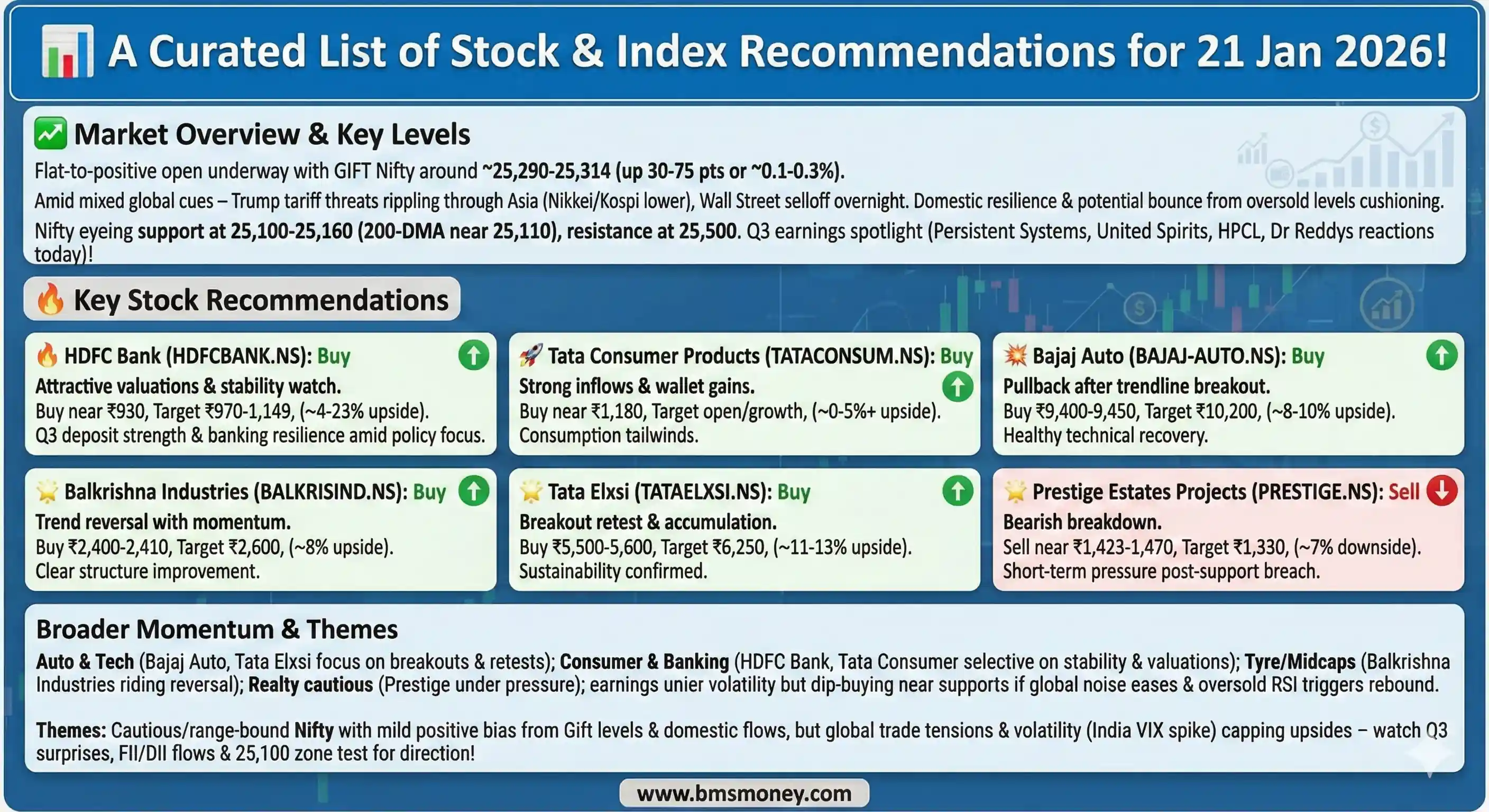

Opening Signal: GIFT Nifty hints at a mildly positive start, attempting to stabilize after the previous session's sharp decline.

-

Global Pressure: Mixed US cues and ongoing US trade threats continue to weigh on overall risk sentiment.

-

Key Themes: Market attention is on IT sector results, banking ahead of RBI signals, and pre-Budget infrastructure buzz.

-

Stock Picks: Selective buying advised in undervalued large-caps like HDFC Bank, with caution on realty.

-

Market Health: Oversold conditions suggest a potential technical rebound, though volatility remains elevated

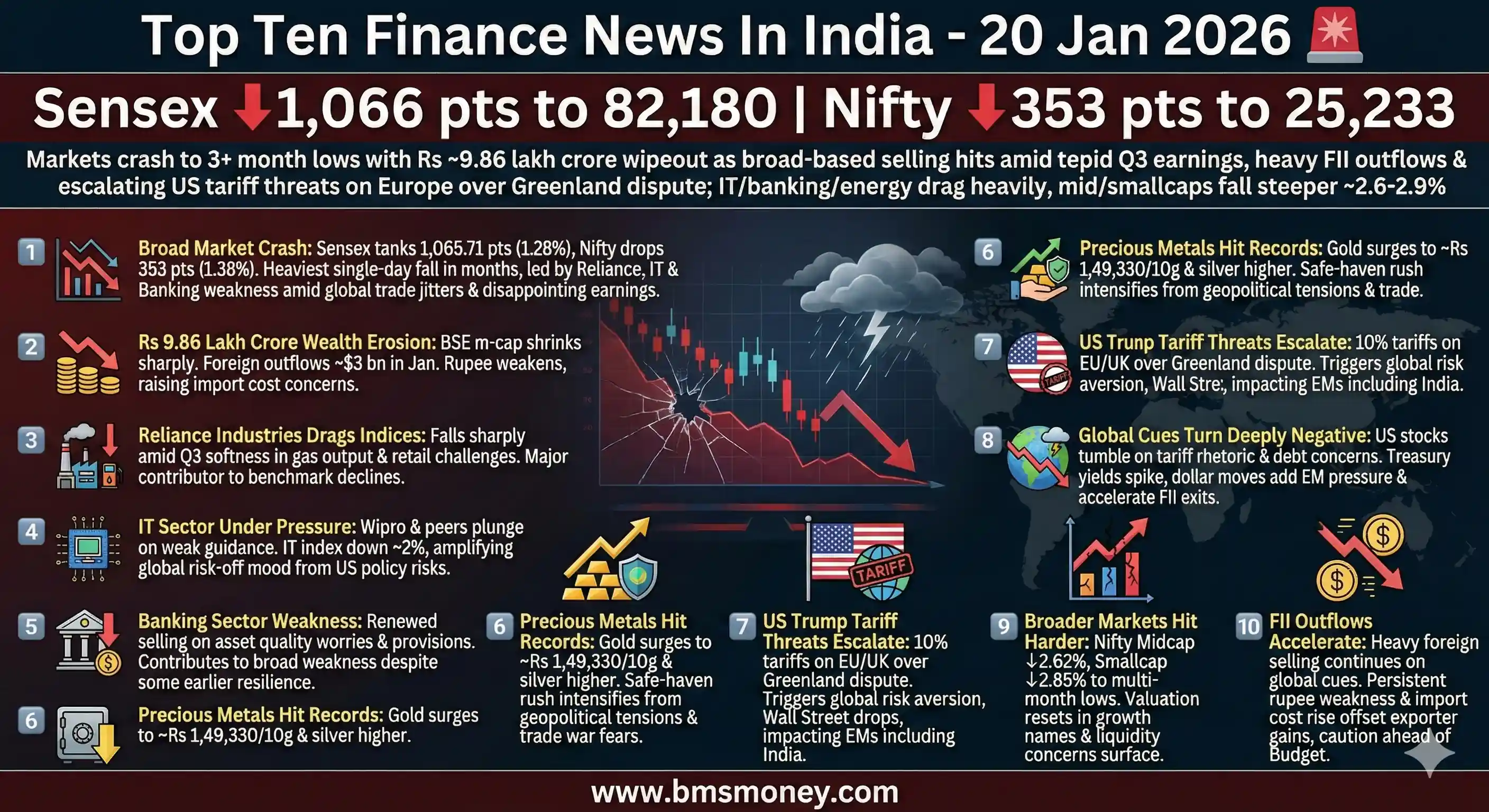

Indian equity markets witnessed a sharp bearish session marked by significant declines in major indices amid escalating global trade tensions, persistent foreign outflows, and disappointing quarterly earnings. Sentiment turned notably cautious with broad-based selling across sectors, leading to substantial wealth erosion, though safe-haven assets like gold surged strongly.

- Sensex and Nifty closed at over three-month lows with heavy losses.

- Market capitalization eroded by nearly Rs 10 lakh crore in a single day.

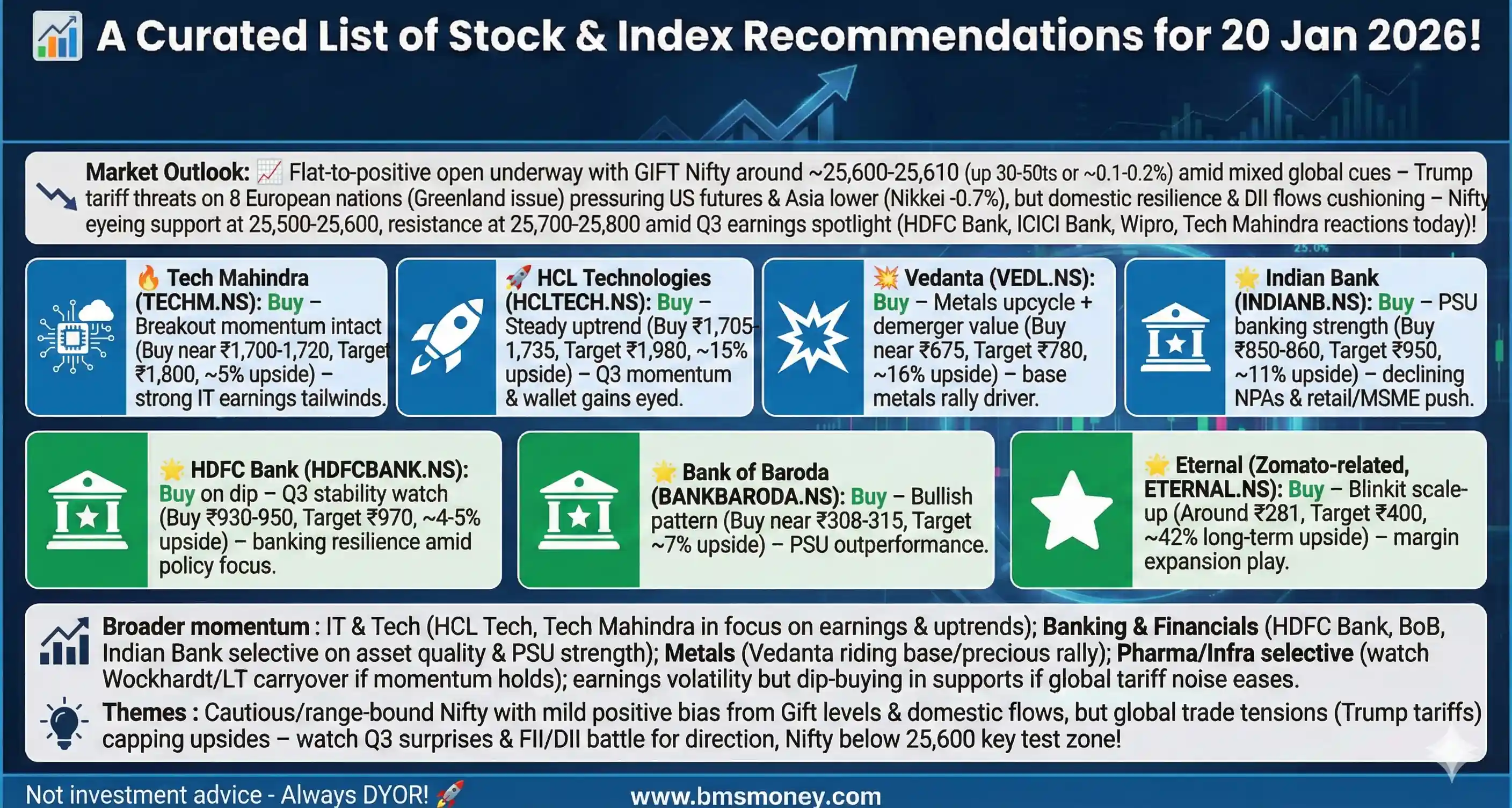

Markets anticipate a cautious, flat-to-positive start on January 20, 2026, balancing global trade tensions with domestic earnings resilience, particularly in the IT sector.

Key Themes & Picks

-

GIFT Nifty signals a marginally higher opening despite global headwinds.

-

IT sector remains a key strength amid strong earnings momentum.

-

Banking sentiment mixed due to ongoing asset quality concerns.

-

Key calls: Upgrades for Tech Mahindra, Vedanta, and HCL Technologies.

-

Elevated volatility persists amid FII outflows and US tariff threats.