Published on: 28 Jan, 2021 03:01

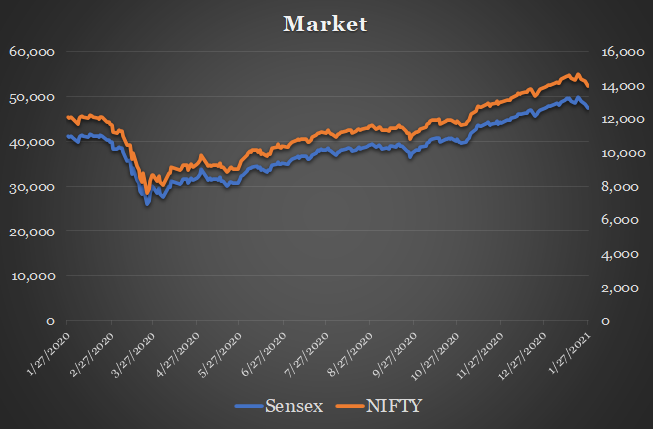

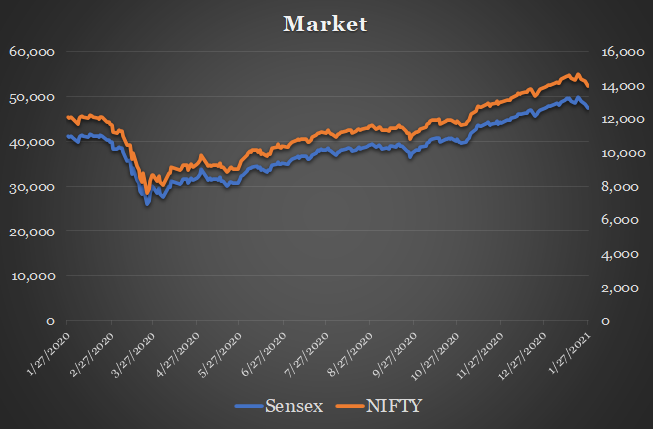

The share market has lost a lot in the last three trading days. Both Sensex and Nifty have fallen from their peaks. Market direction is not very clear at this point. Will it fall further or remain at this level or reverse direction. Before going into deep discussion let's see some basic market statistics:

- On 21st January 2021, Sensex hit an all-time high of 50184.01 points. From that high point, Sensex has fallen 2774 point or 5.53%. In three trading days, Sensex has lost 2774 points

- Nifty hit an all-time high of 14753 points on 21st January 2021 since then Nifty has fallen 786 points or 5.33%. In three days Nifty has lost 786 points.

- Year-to-date Sensex has lost 340 points or 0.7% whereas Nifty has fallen by 14.25 points or 0.1%.

- In the last one year Sensex and Nifty both have given a return of over 15%. (From 27 Jan 2020 to 27 Jan 2021)

Reason for fall in the market:

- Share market is driven by liquidity. Any kind of news which suggests a decrease in liquidity will cause the market to fall.

- The federal reserve (Central bank of united states) drives liquidity by its quantitative easing (QE) (buying securities) if Fed scales back (taper) the QE the liquidity in the market will decrease and it will cause the market to fall (Tantrum).

- Currently, tapper tantrum is happening, given 27th Jan federal reserve meeting and large fall in US share market after that.

- The market will correct further due to this, expecting another 5-10% fall in the market.