| Fund Name |

|---|

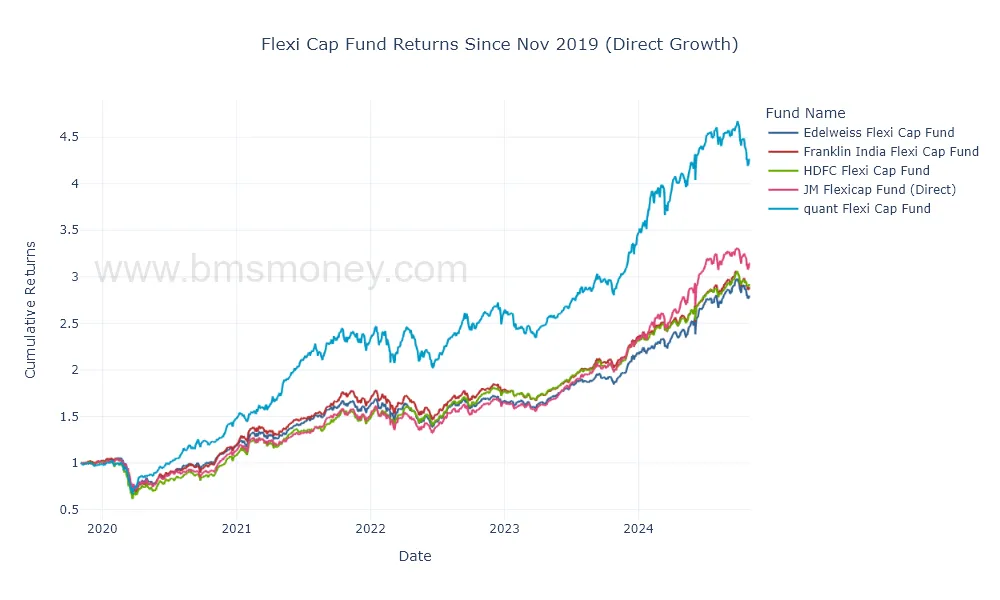

| quant flexi cap fund |

| JM Flexicap Fund |

| HDFC Flexi Cap Fund |

| Franklin India Flexi Cap Fund |

| Edelweiss Flexi Cap Fund |

| HSBC Flexi Cap Fund |

| Fund Name | 5Y XIRR | 5Y XIRR Percentile | 3Y XIRR | 3Y XIRR Percentile | 1Y XIRR | 1Y XIRR Percentile | 1Y Return | 3Y Return | 5Y Return |

|---|---|---|---|---|---|---|---|---|---|

| quant flexi cap fund | 33.70 | 100.00 | 29.04 | 84.62 | 18.36 | 23.53 | 47.99 | 21.98 | 33.33 |

| JM Flexicap Fund | 32.86 | 95.45 | 37.86 | 100.00 | 36.69 | 97.06 | 57.18 | 27.17 | 25.79 |

| HDFC Flexi Cap Fund | 29.84 | 90.91 | 30.29 | 88.46 | 30.00 | 76.47 | 44.99 | 23.80 | 23.79 |

| Franklin India Flexi Cap Fund | 26.84 | 86.36 | 26.73 | 69.23 | 24.60 | 55.88 | 40.12 | 18.15 | 23.43 |

| Edelweiss Flexi Cap Fund | 26.64 | 81.82 | 28.50 | 80.77 | 31.32 | 88.24 | 48.60 | 19.32 | 22.65 |

| HSBC Flexi Cap Fund | 25.65 | 77.27 | 28.15 | 76.92 | 30.54 | 79.41 | 46.13 | 18.46 | 21.87 |

| Motilal Oswal Flexi Cap Fund | 25.15 | 72.73 | 33.33 | 92.31 | 42.00 | 100.00 | 54.35 | 19.88 | 18.00 |

| DSP Flexi Cap Fund | 23.60 | 68.18 | 25.66 | 65.38 | 28.47 | 70.59 | 39.38 | 15.46 | 20.50 |

| Aditya Birla Sun Life Flexi Cap Fund | 22.38 | 63.64 | 23.48 | 53.85 | 25.40 | 61.76 | 39.05 | 14.18 | 19.67 |

| Union Flexi Cap Fund | 22.32 | 59.09 | 21.44 | 30.77 | 17.62 | 14.71 | 31.65 | 14.08 | 20.69 |

- Quant Flexi Cap Fund leads with a strong 5-year XIRR of 33.7%, maintaining the highest percentile ranking in 5-year returns, while JM Flexicap Fund shines in 1-year returns at 36.69% and 3-year XIRR at 37.86%, the highest across all funds.

- HDFC Flexi Cap Fund is consistently strong with a balanced 5-year XIRR (29.84%) and a top-tier 3-year XIRR (30.29%), making it suitable for investors seeking moderate but steady growth.

- Funds like HSBC Flexi Cap Fund and Franklin India Flexi Cap Fund show moderate 5-year XIRRs (25.65% and 26.84%) and maintain percentile rankings within the 70th-90th range, offering stable performance across different time frames.

| Fund Name | Sharpe Ratio | Sortino Ratio | Treynor Ratio | Standard Deviation | Semi Deviation | Max Drawdown | Average Drawdown | VaR 1Y |

|---|---|---|---|---|---|---|---|---|

| quant flexi cap fund | 1.05 | 0.56 | 0.15 | 15.61 | 11.01 | -10.68 | -4.55 | -17.17 |

| JM Flexicap Fund | 1.52 | 0.99 | 0.21 | 13.23 | 8.94 | -8.82 | -3.48 | -9.71 |

| HDFC Flexi Cap Fund | 1.46 | 0.79 | 0.20 | 12.19 | 8.81 | -6.00 | -4.17 | -13.63 |

| Franklin India Flexi Cap Fund | 1.09 | 0.57 | 0.15 | 12.39 | 8.93 | -11.84 | -5.85 | -13.63 |

| Edelweiss Flexi Cap Fund | 1.00 | 0.54 | 0.13 | 13.13 | 9.15 | -12.00 | -4.63 | -13.15 |

| HSBC Flexi Cap Fund | 0.95 | 0.49 | 0.13 | 13.08 | 9.35 | -16.22 | -6.63 | -18.38 |

| Motilal Oswal Flexi Cap Fund | 0.98 | 0.51 | 0.15 | 13.58 | 9.71 | -16.60 | -16.60 | -14.87 |

| DSP Flexi Cap Fund | 0.68 | 0.38 | 0.09 | 13.90 | 9.25 | -17.80 | -7.24 | -14.15 |

| Aditya Birla Sun Life Flexi Cap Fund | 0.69 | 0.36 | 0.09 | 13.00 | 9.23 | -14.98 | -6.72 | -14.66 |

| Union Flexi Cap Fund | 0.73 | 0.38 | 0.10 | 11.63 | 8.17 | -13.49 | -5.17 | -12.96 |

- Union Flexi Cap Fund has the lowest standard deviation (11.63), suggesting it may be less volatile compared to other funds like DSP Flexi Cap Fund with a standard deviation of 13.90.

- JM Flexicap Fund, with the highest Sharpe ratio (1.52) and Sortino ratio (0.99), indicates superior risk-adjusted returns, making it favorable for risk-sensitive investors.

- HSBC Flexi Cap Fund shows a higher maximum drawdown of -16.22% and VaR at -18.38%, indicating potential for sharper declines in adverse markets. This contrasts with JM Flexicap Fund, which has a lower maximum drawdown (-8.82%), suggesting better downside protection.

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsFlexi Cap mutual funds offer a versatile investment option, allowing fund managers to allocate assets across different market capitalizations – large, mid, and small caps – according to changing market conditions. This flexibility is advantageous for investors seeking diversification and growth. In this post, we review the top-performing Flexi Cap funds based on their 5-year XIRR, giving priority to funds that have demonstrated consistent returns along with manageable risk profiles.

Why 5-Year XIRR?

5-Year XIRR (Extended Internal Rate of Return) is a reliable indicator of a fund’s performance over a prolonged period. By focusing on the 5-year XIRR, we can identify funds that have maintained strong returns through different market cycles. This measure is crucial for Flexi Cap funds, where the adaptability to invest across market caps adds variability to returns, and long-term performance reflects the fund's resilience and adaptability.

Top Flexi Cap Funds Based on 5-Year XIRR

Here’s an analysis of top Flexi Cap funds, highlighting each fund’s returns, risk metrics, and notable attributes.

1. Quant Flexi Cap Fund

- 5-Year XIRR: 33.70%

- Sharpe Ratio: 1.05

- Standard Deviation: 15.61%

- Max Drawdown: -10.68%

Quant Flexi Cap Fund leads with an impressive 5-year XIRR of 33.70%, reflecting its robust growth potential. With a Sharpe Ratio of 1.05, it provides efficient risk-adjusted returns. Despite a standard deviation of 15.61%, which indicates moderate volatility, the fund’s max drawdown of -10.68% is relatively low, showcasing resilience during market downturns. This fund is suitable for investors with a higher risk tolerance seeking significant growth.

2. JM Flexicap Fund

- 5-Year XIRR: 32.86%

- Sharpe Ratio: 1.52

- Standard Deviation: 13.23%

- Max Drawdown: -8.82%

JM Flexicap Fund ranks high with a 5-year XIRR of 32.86% and a strong Sharpe Ratio of 1.52, suggesting high efficiency in managing risk relative to returns. The fund’s standard deviation of 13.23% and a lower max drawdown of -8.82% make it a stable choice among Flexi Cap funds, appealing to those who seek high returns with moderate volatility.

3. HDFC Flexi Cap Fund

- 5-Year XIRR: 29.84%

- Sharpe Ratio: 1.46

- Standard Deviation: 12.19%

- Max Drawdown: -6.00%

HDFC Flexi Cap Fund has a solid 5-year XIRR of 29.84%, making it one of the top funds in this category. With a high Sharpe Ratio of 1.46, this fund has demonstrated a strong ability to generate returns without excessive risk. Its standard deviation of 12.19% is relatively low, and with a max drawdown of only -6.00%, it stands out as a conservative option within Flexi Cap funds. This fund is ideal for investors with lower risk tolerance who still aim for substantial returns.

4. Franklin India Flexi Cap Fund

- 5-Year XIRR: 26.84%

- Sharpe Ratio: 1.09

- Standard Deviation: 12.39%

- Max Drawdown: -11.84%

With a 5-year XIRR of 26.84%, Franklin India Flexi Cap Fund balances return with a relatively low-risk profile. The Sharpe Ratio of 1.09 and standard deviation of 12.39% indicate that this fund is well-suited for moderately conservative investors who prioritize stability over aggressive growth. Its max drawdown of -11.84% is slightly higher than HDFC Flexi Cap, but it still maintains a controlled risk level.

5. Edelweiss Flexi Cap Fund

- 5-Year XIRR: 26.64%

- Sharpe Ratio: 1.00

- Standard Deviation: 13.13%

- Max Drawdown: -12.00%

Edelweiss Flexi Cap Fund is another strong performer with a 5-year XIRR of 26.64%. With a Sharpe Ratio of 1.00, this fund has maintained a balanced approach to risk and return. Its standard deviation of 13.13% and max drawdown of -12.00% are reasonable, though slightly higher than some of its peers. This fund suits investors seeking a balance between growth and stability, with some tolerance for risk.

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsKey Risk Metrics Explained

When evaluating Flexi Cap funds, considering risk metrics is essential to ensure that high returns do not come at the cost of excessive volatility. Here’s how each metric influences our assessment:

-

Sharpe Ratio: This ratio helps measure risk-adjusted returns, with a higher Sharpe Ratio indicating better compensation for risk. For example, JM Flexicap Fund’s Sharpe Ratio of 1.52 suggests a well-managed risk-return profile.

-

Standard Deviation: Reflects the fund’s volatility. A lower standard deviation, such as HDFC Flexi Cap Fund’s 12.19%, suggests more stability in returns, which can be attractive to risk-averse investors.

-

Max Drawdown: Measures the largest observed loss from a peak to a trough, offering insight into the fund’s worst-case performance. A lower max drawdown, like JM Flexicap Fund’s -8.82%, provides comfort for investors during market downturns.

-

Value at Risk (VaR): Indicates the potential loss in a worst-case scenario over a one-year period. Quant Flexi Cap Fund’s VaR of -17.17% implies a higher potential loss compared to other funds, whereas HDFC Flexi Cap’s lower VaR (-13.63%) makes it more appealing to conservative investors.

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsConclusion: Selecting the Right Flexi Cap Fund

When choosing a Flexi Cap fund, it’s essential to balance growth potential with risk tolerance. For aggressive investors, Quant Flexi Cap Fund and JM Flexicap Fund provide high 5-year XIRRs and demonstrate robust growth potential, albeit with a higher risk profile.

Conversely, HDFC Flexi Cap Fund and Franklin India Flexi Cap Fund stand out for their relatively lower volatility and solid returns, making them suitable for conservative investors. Edelweiss Flexi Cap Fund also provides a balanced approach, with a steady risk-return profile that could appeal to moderate-risk investors.

These top Flexi Cap funds offer a range of options for diverse investment strategies, whether you aim for high growth or prefer stability with moderate returns. By analyzing both returns and risk metrics, investors can make informed choices aligned with their financial goals and risk appetite.